Today, the biggest question that comes to mind when you save money is how to invest this money or which is the best option for growing it.

Lots of people get confused with Mutual Funds, or SIP, or Lump Sum. But there is a twist, it is not about choosing one over the other, but the fact is that SIP and Lump Sum a ways to invest in Mutual Funds.

Now the real question arises: “Should I invest all my money at once, or bit by bit every month?”

Don’t worry, if you’re confused, you’re not alone. Let’s break it down together, in the simplest way possible.

First, What Are Mutual Funds?

Mutual Funds are an investment option where your money is put together with money from other investors. Then all the money is invested by professionals who invest the amount in shares, bonds, or other assets.

In simple words, you give your money to a professional investor who will use their knowledge and experience of investing to grow your money.

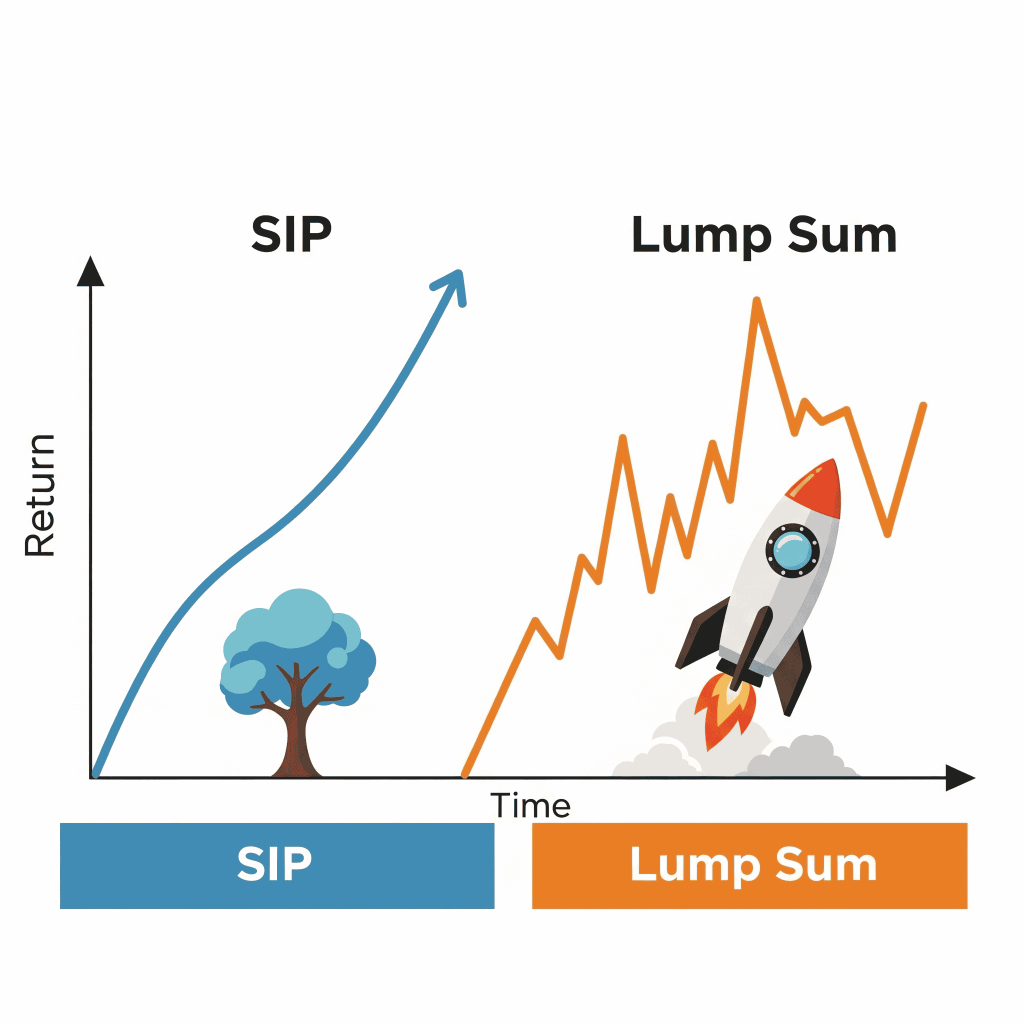

Now, there are two ways to put your money into mutual funds:

- Lump Sum– You invest a big amount at one time.

- SIP (Systematic Investment Plan)– You invest smaller amounts regularly, like ₹500 or ₹1000 every month.

What Is a SIP?

SIP is like a savings habit with a smart twist. Instead of investing a large amount all at once, you invest a fixed amount monthly in a mutual fund.

Let’s say you start a SIP of ₹2000/month.

Every month, that ₹2000 is invested in your chosen mutual fund, no matter what the market conditions are.

This means you buy mutual fund units at different prices, which helps balance out your costs. This is called “rupee cost averaging.”

What Is a Lump Sum?

A lump sum is exactly what it sounds like. You invest a big amount, say ₹50,000, in one go.

This option is usually preferred when:

- You have extra money, like a bonus or gift

- You believe the market is at a good point to invest

- You don’t want to deal with the hassle of monthly deductions

But it also comes with a higher risk, especially if the market falls right after you invest.

SIP vs Lump Sum: Key Differences

| Factor | SIP | Lump Sum |

| Amount Invested | Small fixed amount monthly | A large amount of one-time |

| Ideal For | Salaried, beginners | Experienced, with spare funds |

| Risk Level | Lower (averages market ups/downs) | Higher (timing risk) |

| Discipline | Builds habit | Needs self-control to stay invested |

| Market Timing Needed | No | Yes (preferably low market entry) |

Which One is Better for You?

The answer depends on your financial situation, risk appetite, and goals.

Choose SIP if:

- You are new to investing

- You have a regular income (monthly salary)

- You want to build wealth slowly and steadily

- You are afraid of market ups and downs

Choose Lump Sum if:

- You received a large amount (bonus, FD maturity, inheritance)

- You understand the market well

- You’re okay taking more risks

- You want to make the most of a market dip

Real-Life Example

Let’s say you have ₹1,20,000 to invest.

- With SIP, you invest ₹10,000/month for 12 months.

- With a lump sum, you invest ₹1,20,000 at once.

If the market goes upwards steadily, a lump sum can give better returns.

If the market is volatile or falling, SIP usually performs better because of rupee cost averaging.

That’s why many experts say SIP is safer for the average investor.

What Do Experts Say?

Most financial advisors recommend starting with SIPs, especially for beginners. It removes the stress of “when to invest,” and helps you stay invested for the long term.

If you have extra money later on, you can always do a lump sum top-up.

In fact, many smart investors do both:

- Regular SIPs for long-term goals

- Lump sum when the market drops or for extra savings

Final Thoughts

There is no single answer to “Which is better – SIP or Lump Sum?”

It totally depends on your financial goal.

But if you’re just getting started, here’s a golden rule:

Start early. Start small. Stay consistent.

SIP helps build wealth quietly, over time, like a slow-cooking recipe that tastes amazing at the end.

A lump sum can give quicker results, but it also needs patience and the ability to handle short-term losses.

Whatever you choose, the most important thing is to start investing.

Because the earlier you begin, the stronger your financial future becomes.

Want help choosing the right mutual fund or setting up your first SIP?

Let me know, I’d be happy to guide you further!